The Effects of Tax Cuts & Jobs Act: An Investor’s Perspective

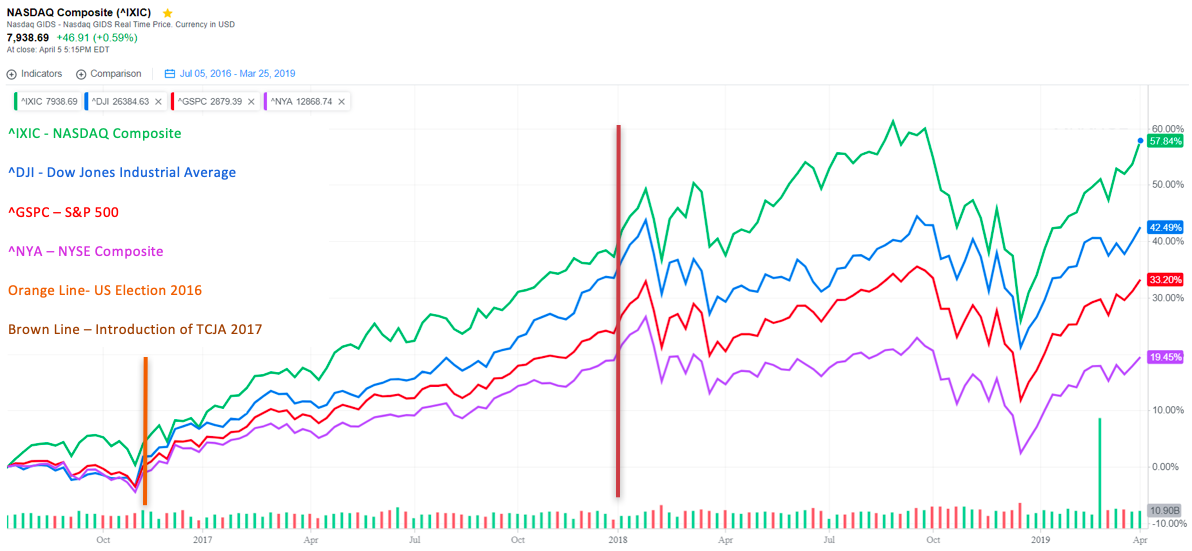

Since the US election of 2016, the country’s leading stock market indexes have emerged as a fairly accurate portrayal for the direction in which the economy is headed.

President Trump’s election campaign focused primarily on deregulations, tax-cuts (for citizens as well as corporations) and job creation. This in part is believed to be a driving factor towards the notable increases in both consumer and business confidence. The signing of the TCJA in 2017 resulted in immediate deregulation, while the tax cuts were put into effect in January 2018. The TCJA has created considerable benefits and can be credited at least in part with the creation of over 5 million jobs, record level unemployment, and major manufacturing companies (such as Ford and General Motors) relocating production back to the US.

Legislators and proponents of the TCJA argued that it would result in stronger economic growth and a boost in investment, which would thus compensate for the reduction in tax revenue. Although the GDP growth rate surpassed expectations, the only major boost in investments was caused by stock buybacks, which exceeded 1.1 trillion dollars in 2018. Critics of the Trump administration frequently pointed out the manner in which the tax cuts overwhelmingly favored corporations. However, stock buybacks specifically can have a beneficial impact on the general population, both in the short and long term.

Stock buybacks are purchased with intention of raising the market price of an undervalued stock. They reduce the number of shares left in the market, increasing the value of each outstanding share. Along with the tax relief provided to corporations through the TCJA (a 14% reduction), US investments in R&D projects have been gradually slowing down over the past few years, permitting businesses to invest additional profits and/or savings into stock buybacks. The large-scale stock buybacks, resulting in real capital gain, along with the additional retained earnings resultant from tax cuts have incentivized companies to strengthen existing relationships with both clients and employee’s. This can occur in the form of bonuses to clients and workers, larger and more frequent dividend payouts, an increase in contributions to retirement/pension funds or through wage increases.

The US saw wages rise by 2.8% in 2018 with tax relief being the driving factor. According to the S&P 500, average shareholder yield went from 4.32% in 2017 to over 4.95% in 2018. With over 50% of working-age Americans owning stocks and a retirement/pension fund, stock buybacks can be very profitable. According to the National Taxpayers Union Foundation, the average retirement account grew by at least $730 dollars from 2017 to 2018. The NTUF stated that seniors were the predominant beneficiaries of the stock buybacks spurred by the TCJA.

The massive stock buybacks witnessed in 2018 usually indicate companies experiencing a surplus, in the form of revenue, excess cash, cuts to spending or additional income on profitable investments. In the absence of more profitable business ventures, a company prefers to repurchase their stocks and focus on improving the rapport with its shareholders and employees. In the long run, the company will be more flexible to sell stocks and raise funds for future investment opportunities. Meanwhile, shareholders will have more financial independence to invest elsewhere. However, investors will remain reluctant in pursuing an investment without being able to verify the stability of financial growth, which can take much longer than one year.

There are several arguments to be made against corporate stock buybacks. Although a company may focus on repurchasing its own stock, there is no obligation to invest in its clients or business. Hence, certain shareholders and workers may never receive any additional benefits. Likewise, a company can choose to invest solely in its shareholders while ignoring their workers, contributing to the national and global inequality levels. Stock buybacks could signify a bigger, underlying issue in the economy: executives realize the lack of investment opportunities in their own company and decide to return money to the investors through buybacks. This can lead to the accumulation and hoarding of wealth, in addition to the absence of newer investment opportunities, showing that the robust economic growth of the last several decades has come to a slowdown or potentially a halt.

Overall, the US stock markets have reacted favorably to the TCJA. In September 2018, NASDAQ closed at an all-time high. This was followed by the midterm elections and a lengthy government shutdown which lasted from December 2018 to early February 2019, causing the stocks to plummet. The recovery of the stock market since the government shut down has been exponential, with NASDAQ, Dow Jones and S&P 500 growing by 57.84%, 42.49% and 33.20% respectively, compared to election day in 2016. Although stock buybacks have significantly outperformed investments, the influence of the TCJA allows companies to invest in their own business and shareholders, proving to be beneficial to Americans who have already invested or who are investing in stocks, without harming the economy.