Market Basics: High-Frequency Trading

High frequency trading, often shortened to HFT is the use of sophisticated trading platforms by large investors such as banks and hedge funds. These platforms function on highly advanced technology based on complex algorithms, which can spot a trend in a matter of milliseconds and execute the desired number of trades on that recognized asset.

What are the goals and consequences of this type of trading?

By adding a large amount of trades to the market liquidity increases, while the bid-ask spread[1] shrinks. Thus, high-frequency trading has profound advantages for individuals and institutions active on the financial market. Not only do they largely shape the market, which is commonly referred to as ‘market making’, but they are capable of realising profit on the specific bid-ask spread involved with the targeted trade. Due to its heavy reliance on advanced technology, high frequency trading is most commonly utilized by the large firms possessing sufficient capital to invest into this technology. Consequently, high frequency trades involve very large amounts, hence explaining its aforementioned market making ability.

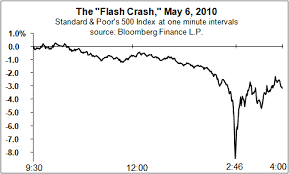

Although high frequency trading offers many advantages due to its ability to detect trends within microseconds after they are initiated, the underlying algorithm occasionally has disastrous consequences. For example, so-called flash crashes (high frequency automatically selling off in large volumes to avoid losses, causing the market to decline rapidly) and other failures of algorithmic platforms have almost led boutiques to bankruptcy.

Figure 1: Graphical presentation of a flash crash

How did HFT develop?

1998 – The SEC authorises a computer to execute high frequency trades. This new machine is able to execute trades 1000 times faster than a human.

2000 – HFT represents a bit less than 10% of global equity trading.

2005 – Levels reach 35% of equity trades in the US.

2010 – 1 trillion evaporated as DOW plunged 1000 points due to computerised sell-orders. HFT reaches 56% of global trades executed.

2012 – Now represents 70% of global trades.

2014 – 10 year government debt plunges then becomes bullish. Traders accused of high frequency flipping of government debt.

2016 – British Pound plunges 800 points in a few minutes. Economists blame HFT.

What does the future of HFT look like?

As stock exchanges have increased the cost of trading adding to the lower volatilities of the markets, various economists and experts are assuming that the golden era of high frequency trading is over. On the other hand, other sources state that the increased technological progress enabling traders to execute more and more transactions in a shorter period of time offsets those rising costs. Competition also plays a role, as HFT firms benefit from being the fastest, optic cables have been replaced by microwaves technology.

To sum up, HFT adds liquidity, but is risky because of algorithmic crashes. Active firms need to stay highly updated keep track of the technological changes to anticipate the future of HFT and the largest portion of market trades.

[1] For more on the bid-ask spread, please visit https://www.investopedia.com/terms/b/bid-askspread.asp