Market Basics: Bitcoin (BTC), Ripple (XRP), Litecoin (LTC), Ethereum (ETH)

Bitcoin

Bitcoin (BTC for short) was created in 2008 by the mysterious Satoshi Nakamoto. He released the project on a whitepaper (an authoritative report or guide that informs readers concisely about a complex issue and presents the issuing body's philosophy on the matter) in which he explained the aim and functioning of the underlying technology. In this document, he further described the innovative payment method as a peer-to-peer medium for online cash payments. In essence, what the creator wanted to replicate was an electronic method to exchange cash like we are used to do in shops. AMSA believes that cryptocurrencies eventually will replace cash and it is just a matter of when rather than if. We base this assumption on the fact that pure cash payments are decreasingly favoured by governments in the mission to track all transactions that take place. Not just criminals, as is commonly pointed out by critics, but also individuals with data privacy concerns and which value their anonymity could benefit from this electronic cash alternative.

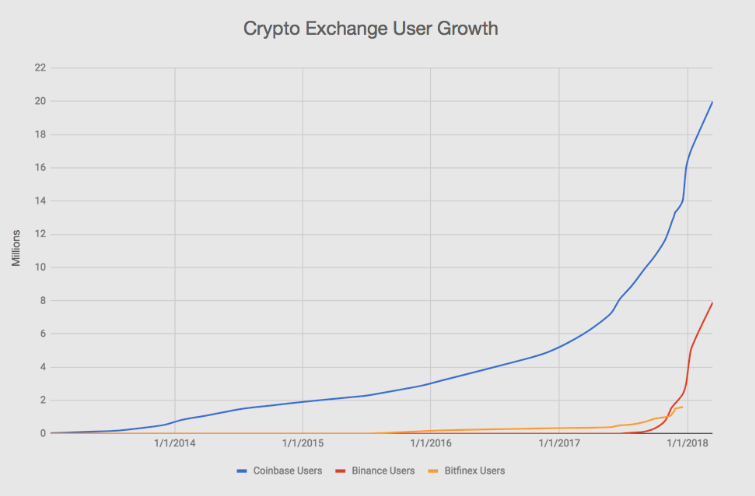

As is depicted on the graphs above, cash payments and ATM withdrawals are steadily decreasing while debit card payments and crypto account users have been growing constantly, with the 2017 crypto boom further accelerating this rate drastically. Having said this, it is safe to say that more and more individuals use cryptocurrencies as a payment method, even before the 2017 turmoil.

In light of this information and shifting the perspective back to Bitcoin, the technology runs on the blockchain system. Shortly, it is a decentralised network of ‘miners’ with highly technologically advanced computers which serve the purpose of verifying the transactions. For more on blockchain, please read our previous article written two weeks ago. The increase in the number of bitcoin transactions, as shown in the top right graph has made transfer times longer which is working against Nakamoto’s initial intention. Consequentially, various experts have labelled BTC long-term storage value than real economic cash because of its primitive characteristics compared to other crypto coins. These characteristics mainly comprise the aforementioned longer transaction times and harmed liquidity due to the 2017 surge in BTC price. Liquidity has since improved, with prices dropping back from an all-time high (ATH).

Ethereum

This project was launched by parent company Ether. Ethereum also runs on the blockchain technology but is slightly different. Ethereum is used for the elaboration and exploitation of smart contracts. Smart contracts have been explained in more detail within the previous article. In short, smart contracts are electronic copies of contracts which can be accessed through the blockchain and specify the deal characteristics. Once all conditions have been met by the different parties involved in the deal, the transaction or project will be automatically executed. It is less prone to error, more up to date in terms of conditions and time efficient as the deal is executed based on conditions met by parties involved.

We have seen the adoption of Ethereum blockchain by firms as J.P. Morgan and Microsoft, which are working hard to implement the technology as soon as possible. It is also widely utilized for the development of apps, as it simplifies contact between geographically dispersed parties during contract negotiations and business deals.

Ripple

Ripple can be best described through a practical example. As one of the world’s largest multinationals, Google has millions of payments to execute every day to partners, such as app developers and independent research and development units. Due to this unique combination of high volume and low value within the transactions, accountants and transaction officers could save a lot of time by using this cryptocurrency. To tackle this issue, and assist firms such as Google, Ripple has developed XRP. This is predominantly meant for financial institutions and acts as a bridge between fiat conversions (fiat being the regular currencies like the Euro, Dollar or Yen). The transaction time aims to be just 4 seconds, but as previously mentioned waiting times may increase with the growing number of transactions and users. A further considerable advantage are the transaction fees. The start-up claims to have completely eliminated transaction fees and has been working with credit card companies Banco Santander and American Express to make this technology a reality.

We will finish this part off with a fun fact. During the cryptocurrency boom of 2017, the Ripple CEO went up to be ranked fifth on the Forbes 400 list with holdings worth $59.9 billon. At that time, XRP was worth $3.84. His net worth has since dropped back to $37.3 billion.

Litecoin

Litecoin is BTC’s greatest current rival by serving a similar purpose and adopting the same technology. Litecoin is predominantly meant for fast-paced payments and guaranteed liquidity. The latter is assured by an international supply of 84 million coins and a transaction time which is four times faster than that of Bitcoin. Charlie Lee, founder of Litecoin highlighted the rivalry between BTC and LTC in an interview with CNBC. "Litecoin is very similar to bitcoin except it has four times as many coins. It's also four times faster". He clearly believes in the value-storage assumption regarding BTC and advocates his currency as more efficient option for overseas payments.